A must-read for smart people: A complete guide to choosing car insurance

Car insurance is essential for every vehicle owner. It provides financial protection in the event of accidents, theft, or damages. Whether you're a seasoned driver or new to the road, understanding your options can save you money and reduce stress. This guide will help you navigate car insurance with practical examples and real-life scenarios.

Why Do You Need Car Insurance?

Car insurance is required by law in most states and protects you, your passengers, and others on the road. Without it, you face significant risks, including:

Out-of-pocket expenses: You may have to pay for repairs or medical bills after an accident.

Legal penalties: Driving without insurance can lead to fines, license suspension, or jail time.

Liability risks: If you're at fault in an accident, you could be sued for damages.

Example: John in California was involved in a minor collision. His liability insurance covered the other driver's medical bills and vehicle repairs. Without insurance, John would have had to pay for these costs himself, which would have been financially devastating.

Types of Car Insurance

Different types of car insurance offer varying levels of protection. Here’s a breakdown of each type:

Bodily Injury Liability: Pays for medical expenses and lost wages if you cause an accident.

Property Damage Liability: Covers repair costs for someone else’s property, like their car or fence.

Example: Emily in New York was at fault in a crash. Her liability insurance covered the $10,000 in medical bills and $5,000 in property damage for the other driver.

2. Collision Insurance

Collision insurance covers repairs to your own car after an accident, regardless of who is at fault.

Example: Sarah in Texas lost control of her car on a rainy day and hit a guardrail. Collision insurance covered the $8,000 repair cost, minus her deductible.

3. Comprehensive Insurance

This covers damage from non-collision events like theft, vandalism, or natural disasters.

Example: Mark in Florida had his car damaged during a hurricane. Comprehensive insurance covered the $5,000 in repairs, minus the deductible.

4. Uninsured/Underinsured Motorist Insurance

This protects you if you're in an accident with someone who has no insurance or insufficient coverage.

Example: Lisa in Arizona was hit by an uninsured driver. Her uninsured motorist insurance covered $7,000 in car damage and $2,000 in medical bills.

5. Personal Injury Protection (PIP)

PIP covers medical bills and lost wages for you and your passengers, regardless of fault.

Example: After an accident, Jake in Michigan needed surgery for a broken leg. PIP insurance covered the hospital bills and part of his lost wages while he recovered.

How to Choose the Right Policy

Choosing the right insurance policy depends on factors like your driving habits, vehicle value, and budget:

1. Evaluate Your Needs

If you drive in a high-accident area or have an expensive car, more comprehensive coverage may be worth it.

Example: A couple in Los Angeles chose higher liability and collision coverage because of the city’s dense traffic and high accident rates.

2. Know Your State’s Requirements

Every state has different minimum insurance requirements. Check your state’s laws to ensure you meet the legal requirements.

Tip: While meeting the minimum requirements is necessary, consider adding extra coverage for better protection.

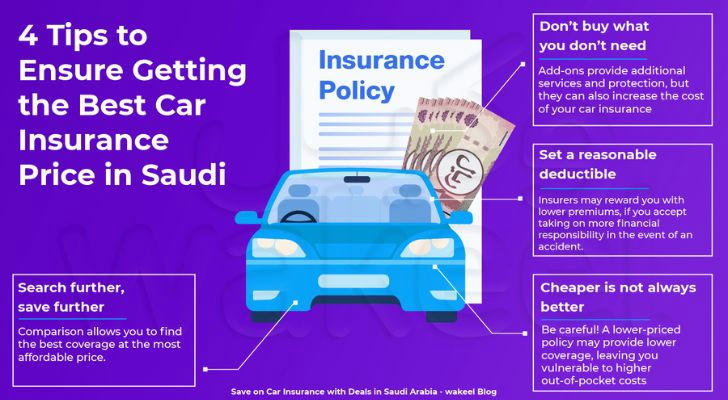

3. Compare Quotes

Get quotes from multiple insurers to find the best balance of price and coverage. Use online comparison tools or work with an independent agent to get options from several companies.

Example: Olivia in Texas compared quotes from three companies and chose a plan that offered better coverage for just $30 more per month.

4.Check Deductibles and Premiums

A higher deductible lowers your monthly premium, but make sure you can afford the deductible if you need to file a claim.

Example: Kevin had a 2010 Honda Civic and chose a higher deductible to lower his premium. It worked for him, but drivers with less savings might want a lower deductible.

5. Look for Discounts

Many insurers offer discounts for safe driving, bundling policies, or having anti-theft devices.

Example: Sarah received a 10% “safe driver” discount after maintaining a clean driving record for five years.

Common Car Insurance Myths

Myth: "Red cars cost more to insure."

Fact: The color of your car doesn’t impact your insurance rate. Insurers focus on your driving history, vehicle make, and model.

Myth: "Old cars don’t need full coverage."

Fact: While older cars may not need full coverage, collision and comprehensive insurance can still be valuable if repair costs are high.

Myth: "Credit scores don’t affect car insurance."

Fact: Many insurers use credit scores to help determine premiums because they are linked to the likelihood of filing claims.

Filing a Claim: What to Do

If you need to file a claim, follow these steps:

Document the Incident: Take photos of the damage and collect the other driver’s details.

Contact Your Insurance Company: Notify your insurer as soon as possible.

Submit Required Documents: Provide necessary paperwork, such as the police report.

Work with the Claims Adjuster: The adjuster will assess the damage and determine the payout.

Repair Your Vehicle: Choose a repair shop recommended by your insurer for quality repairs.